Local flexibility, global consistency

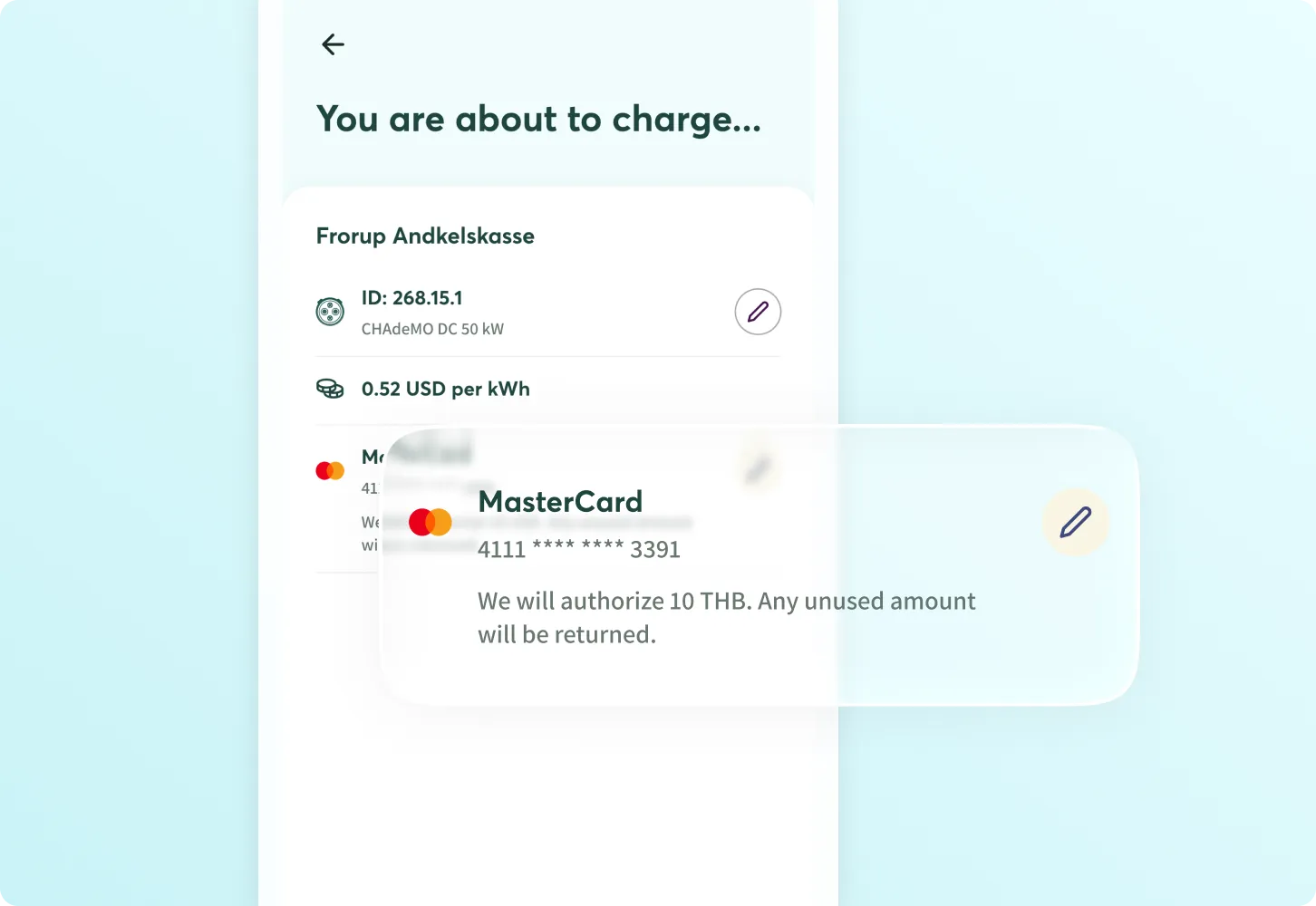

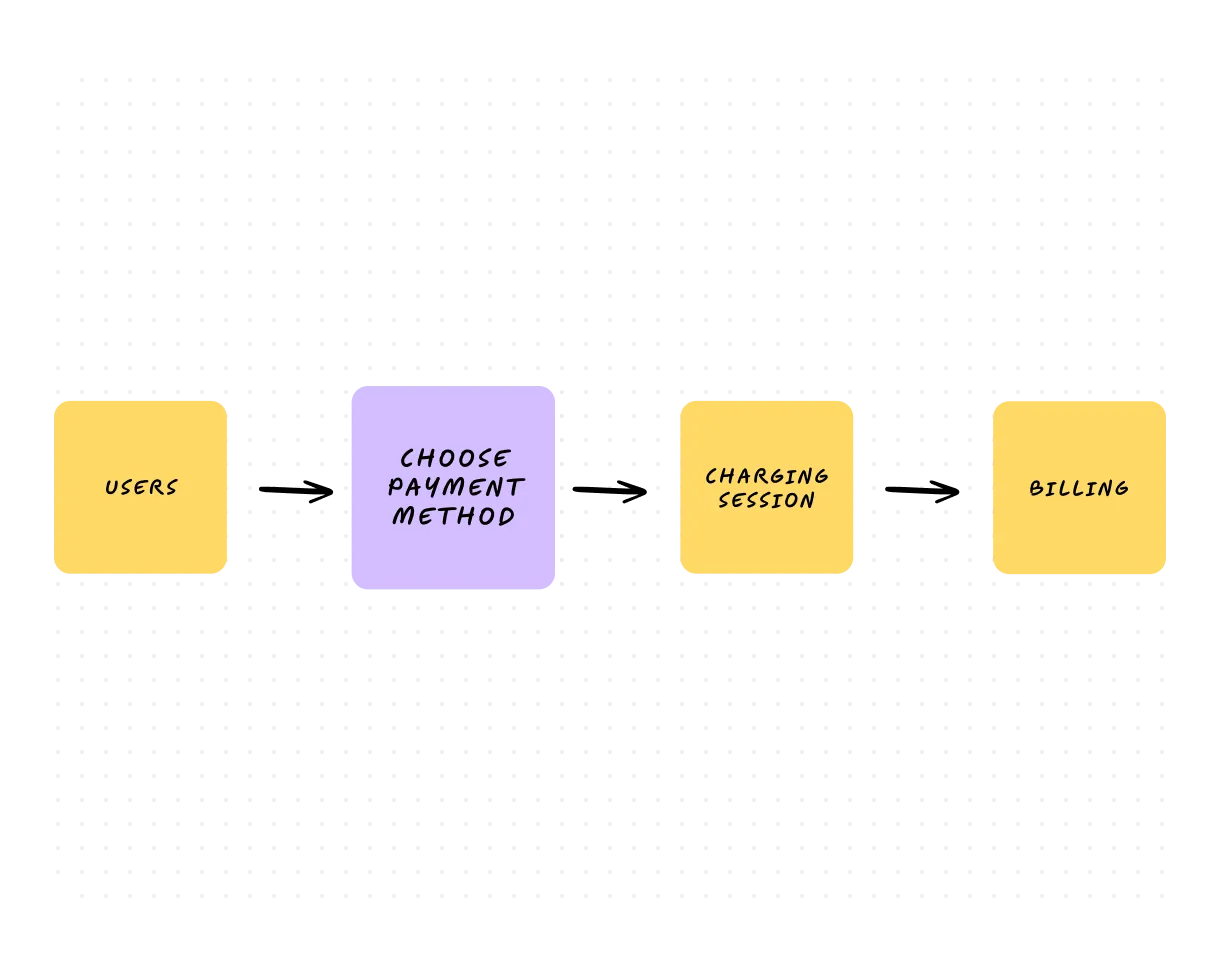

In some countries, drivers expect to authorize a fixed amount before charging; in others, post-payment or wallet-based charging is standard. EOSVOLT bridges these regional differences by letting white-label operators configure their own payment flows. Each strategy integrates seamlessly with your preferred gateway, loyalty setup, and backend reporting — ensuring you stay aligned with local norms without fragmenting your global operations.

Local flexibility, global consistency

In some countries, drivers expect to authorize a fixed amount before charging; in others, post-payment or wallet-based charging is standard. EOSVOLT bridges these regional differences by letting white-label operators configure their own payment flows. Each strategy integrates seamlessly with your preferred gateway, loyalty setup, and backend reporting — ensuring you stay aligned with local norms without fragmenting your global operations.

Wallet Top-Up

Enable prepaid charging with stored credit.

Operators can activate an optional Wallet module that lets users add funds in advance and pay for future charging sessions from their balance. It’s ideal for prepaid or loyalty-based models and supports local payment methods in markets with limited card infrastructure.

Wallet Top-Up

Enable prepaid charging with stored credit.

Operators can activate an optional Wallet module that lets users add funds in advance and pay for future charging sessions from their balance. It’s ideal for prepaid or loyalty-based models and supports local payment methods in markets with limited card infrastructure.

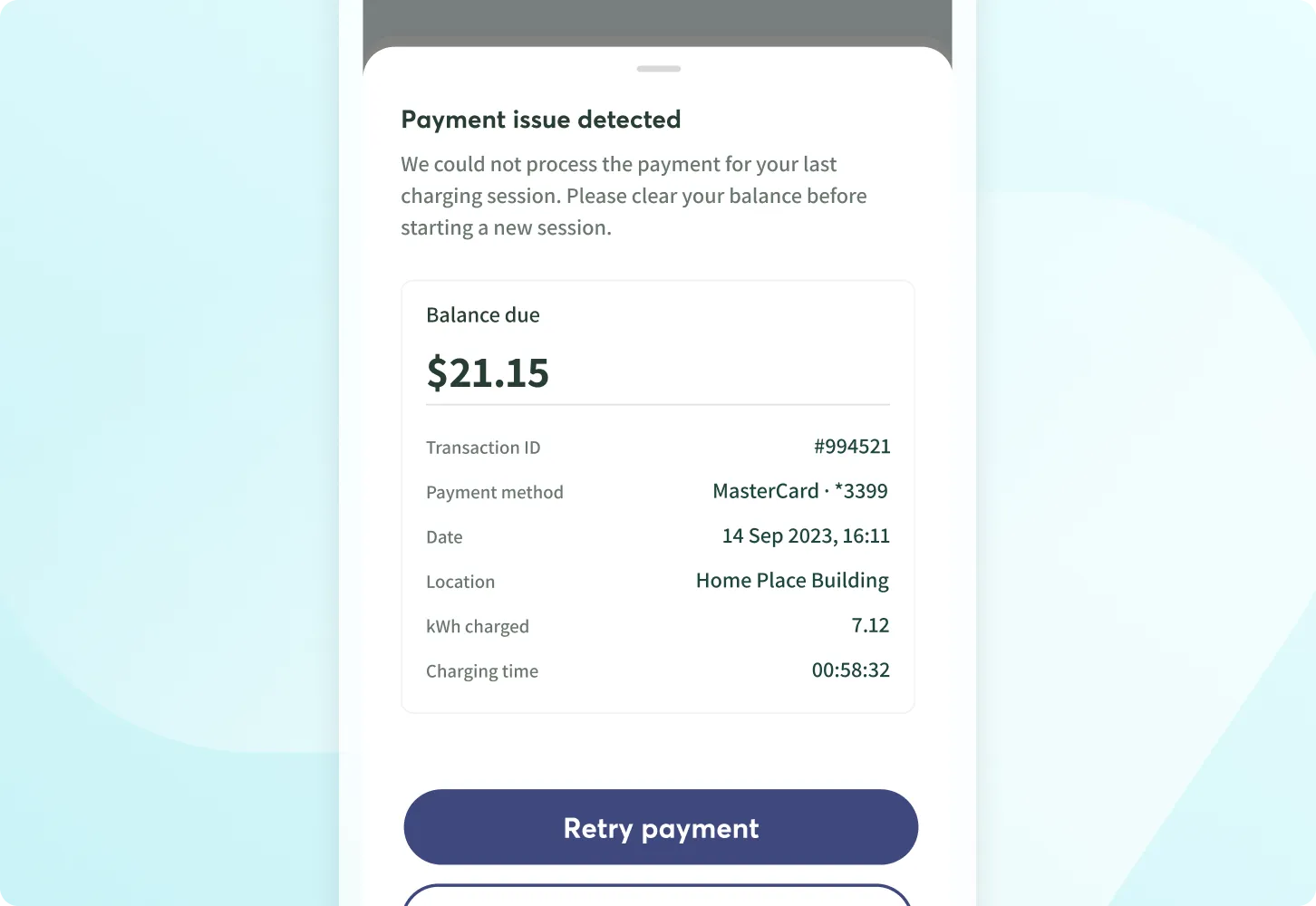

Negative Balance Recovery

Recover missed payments automatically.

When a payment attempt fails, due to card expiry, insufficient funds, or network errors, EOSVOLT automatically records the outstanding balance. The platform then retries payment at the user’s next session, ensuring revenue is recovered seamlessly without manual follow-up.

Negative Balance Recovery

Recover missed payments automatically.

When a payment attempt fails, due to card expiry, insufficient funds, or network errors, EOSVOLT automatically records the outstanding balance. The platform then retries payment at the user’s next session, ensuring revenue is recovered seamlessly without manual follow-up.

Build payment experiences that fit your market.

With EOSVOLT’s Payment Strategies, you control exactly how users pay for charging. Adapt your flow to local preferences and ensure smooth, reliable transactions every time.

Start building smarter Payment Strategies with EOSVOLT today.